From January 2020, smaller employers, with a paybill of less than £3 million, and who therefore do not pay the Apprenticeship Levy have had the opportunity to arrange Apprenticeship training and funding through the Apprenticeship Service.

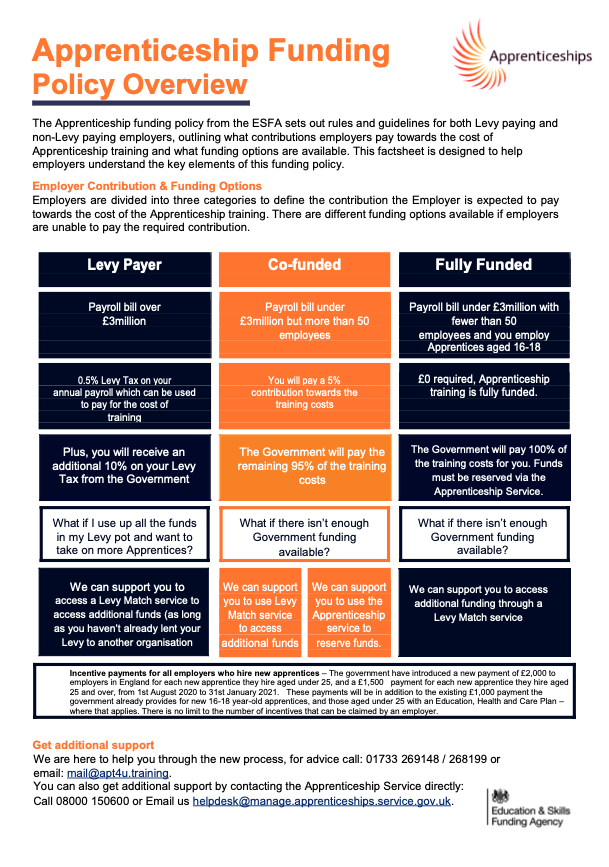

Employers are divided into three categories to define the contribution the Employer is expected to pay towards the cost of the Apprenticeship training. There are different funding options available if employers are unable to pay the required contribution. For more information to see what you qualify for, select your current circumstance below:

What is the Apprenticeship Levy?

The Apprenticeship Levy is a levy on UK employers to fund apprenticeships. The purpose of the Apprenticeship levy in England is to put the control of Apprenticeship funding in the hands of the employer, through the Apprenticeship Service.

Who does the Apprenticeship Levy apply too?

The levy applies to any UK employers who have an annual paybill of over £3 million. These employers then receive a £15,000 levy allowance per year, to offset against any levy they must pay. Should an employer have workforce both within and outside of the UK, the levy is only paid on workforce within the UK.

How do I pay my Apprenticeship Levy?

Once set-up with HMRC, the employer is required to make a monthly investment of 0.5% of the wage bill, through PAYE. Once the monthly levy has been paid, the government will provide a 10% top-up and funds for training will become available.

What can I use my Apprenticeship Levy funds for?

Levy funds can be used for Apprenticeship training, through providers who are successfully registered on the Register of Apprenticeship Training Providers (RoATP), such as APT. Speak to our Business Development Team today for further advice and guidance.

What if my organisation doesn’t pay the Apprenticeship Levy?

If an employer’s annual wage bill is less than £3 million, they will not pay the Apprenticeship Levy and will be eligible to receive government support. Dependent on criteria of the apprentice and employer, an employer will be required to contribute 5% of the Apprenticeship price.

Incentive payments for all employers who hire new apprentices

The government have introduced a new payment of £2,000 to employers in England for each new apprentice they hire aged under 25, and a £1,500 payment for each new apprentice they hire aged 25 and over, from 1st August 2020 to 31st January 2021.

These payments will be in addition to the existing £1,000 payment the government already provides for new 16-18 year-old apprentices, and those aged under 25 with an Education, Health and Care Plan – where that applies.

There is no limit to the number of incentives that can be claimed by an employer.

Summary of incentives from 1st August 2020 to 31st January 2021

16-18 apprentice incentive – £3,000

18-24 apprentice incentive – £2,000

25+ apprentice incentive – £1,500